Inside Ownership Index

Empowering Investors with Insider Insights

About the Index

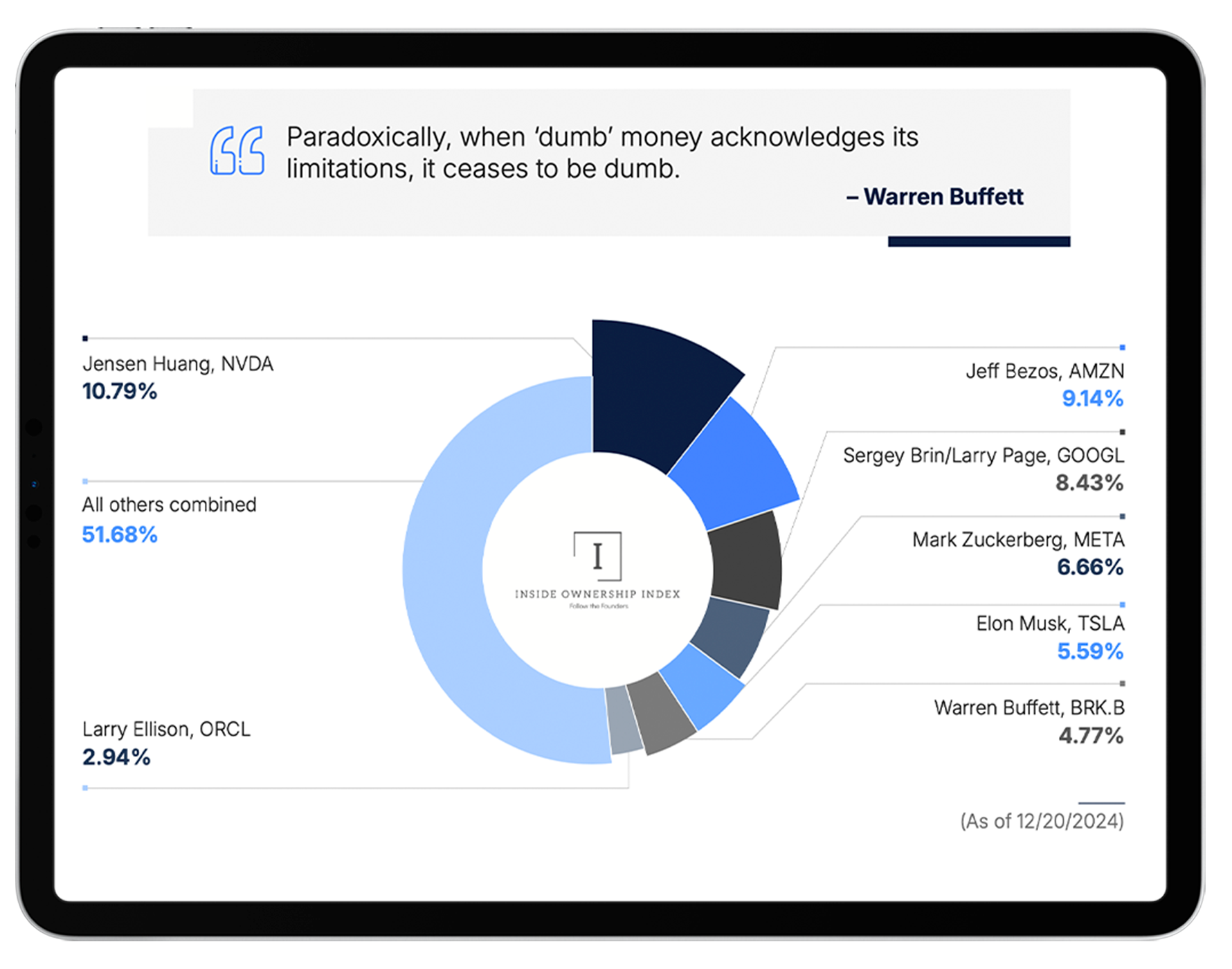

We believe the S&P’s methodology is flawed. They increase constituent weightings as corporate insiders sell and decrease the weighting when insiders buy. For example, Amazon’s market cap is Free Float adjusted to exclude shares owned by Jeff Bezos when determining its weighting in the S&P 500. Therefore, as Jeff Bezos sells his stock or retires, the S&P increases the free float factor, leading all funds that track the S&P 500 to buy more Amazon shares. We prefer to be overweight in Amazon while Jeff Bezos is involved and buying, and reduce our exposure when he retires or sells.

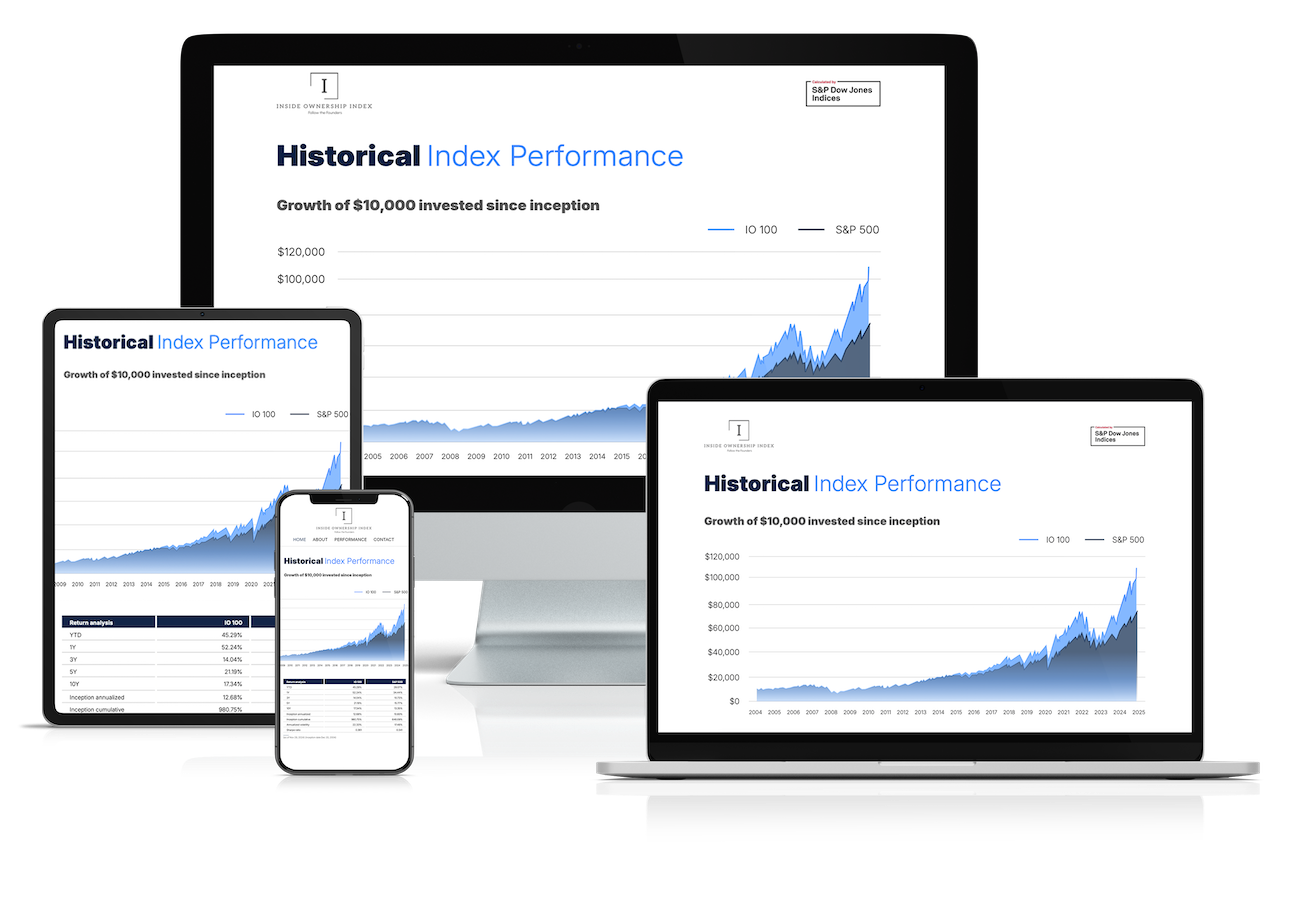

By weighting stocks based on the value of inside ownership, we systematically overweight companies with high inside ownership and underweight those with low inside ownership. This simple methodology has produced a 2% per year alpha against the S&P 500 since 2005 when data became available.

By periodically investing in an index fund, the know- nothing investor can actually outperform most investment professionals.

- Warren Buffett

Insider-Driven Success

Why Inside Ownership Matters

"Non-Skin in the Game people don’t get simplicity."

- Nassim Taleb

Top 10 Holdings

Investigate Companies in the Index

Q4 2025: Top 10 Holdings

|

Q4 2025: Top 10 Holdings

|

|||||||||

|---|---|---|---|---|---|---|---|---|---|

|

Alphabet Inc A

|

GOOGL

|

+11.59%

|

|||||||

|

Nvidia Corp

|

NVDA

|

+11.24%

|

|||||||

|

Amazon.com Inc

|

AMZN

|

+8.26%

|

|||||||

|

Meta Platforms, Inc. Class A

|

META

|

+6.29%

|

|||||||

|

Tesla, Inc

|

TSLA

|

+5.78%

|

|||||||

|

Berkshire Hathaway B

|

BRK.B

|

+4.53%

|

|||||||

|

AVGO

|

Broadcom Inc

|

+3.35%

|

|||||||

|

Oracle Corp

|

ORCL

|

+2.99%

|

|||||||

|

Palantir Technologies Inc. Class A

|

PLTR

|

+2.29%

|

|||||||